Malaysia charges forward with budget-friendly EV Road Tax: as low as RM40 yearly from 2026

Electric vehicles (EVs) are gaining traction in Malaysia, and the government is stepping on the gas to accelerate adoption. Recently, the new EV road tax structure for 2026 was announced, offering exciting news for eco-conscious drivers. Here's what you need to know.

The new system prioritizes affordability, with fees significantly lower than the previous structure and even cheaper than road tax for traditional gasoline or diesel vehicles. This move aims to make EVs a more attractive option for Malaysian drivers.

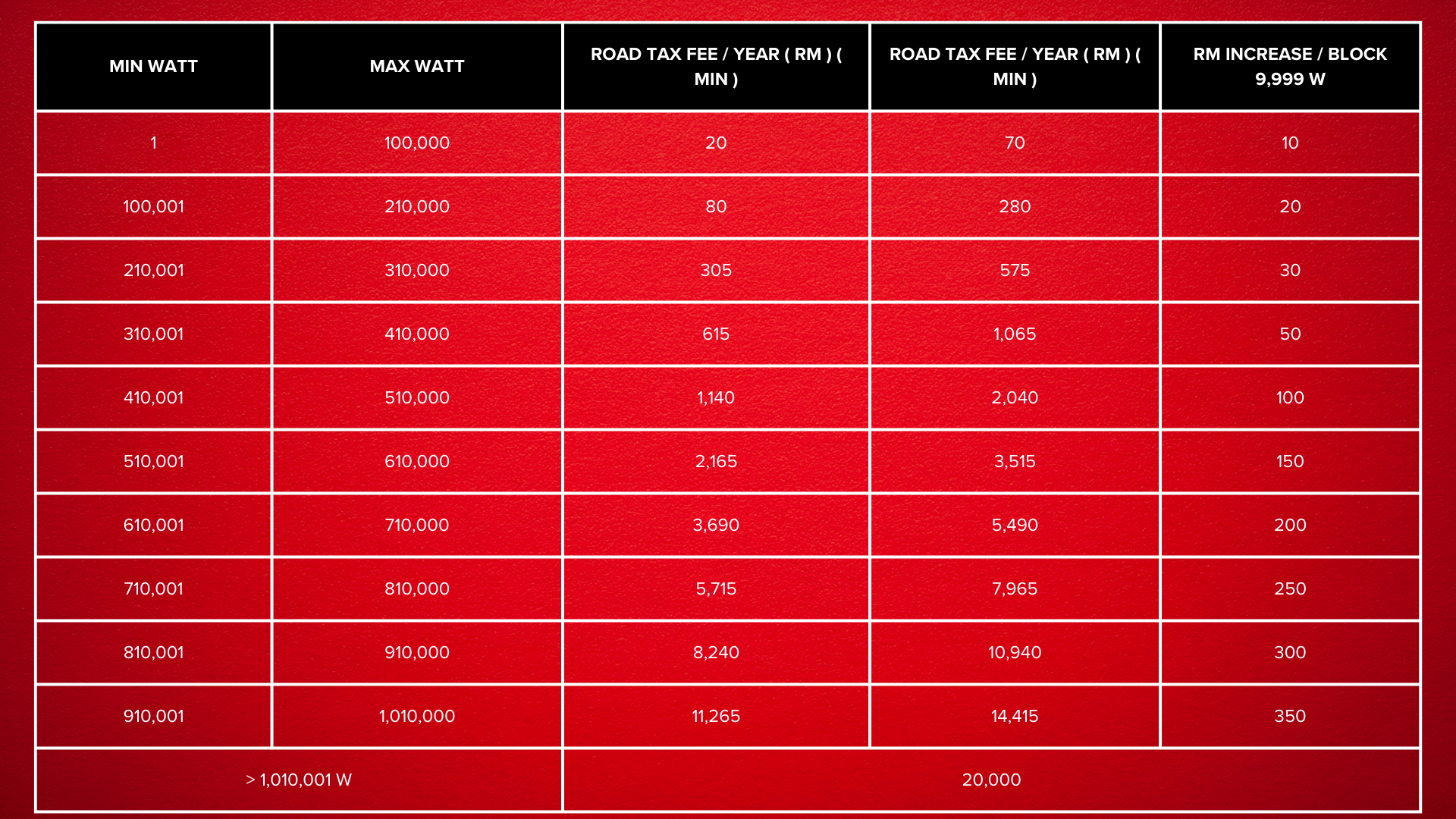

The new structure calculates road tax based on a vehicle's kW (kilowatt) rating, reflecting its battery power. The lowest tier starts at an incredibly budget-friendly RM40 per year! This could significantly reduce ownership costs compared to ICE vehicles.

The system is designed for clarity. EVs are categorized into specific kW bands, with fees increasing progressively for higher-powered models. This transparency allows drivers to estimate their annual road tax easily.

Let's see how the new structure translates to real-world savings. Popular models like the BYD Dolphin and Neta V (both 70 kW) will see their road tax drop to just RM40 annually, a significant decrease from previous rates. Even high-performance EVs like the Mercedes-Benz EQE 350+ will benefit, with its road tax falling from a staggering RM2,779 to a more manageable RM305.

This new tax structure is a clear signal of the Malaysian government's commitment to promoting EVs. By making them more affordable to own, the government hopes to incentivize widespread adoption and transition the country towards a cleaner, more sustainable transportation future.

With these exciting developments, there's never been a better time to consider an EV in Malaysia. With lower road tax and ongoing incentives, going electric is becoming a financially and environmentally sound choice. So, research available EVs, explore charging options, and embrace a greener driving experience.